debaka.ru Market

Market

How Much Does The Bank Make On A Mortgage

A mortgage is made up of four parts: The principal amount, interest, taxes and insurance. Remember that any time you borrow a loan of any kind, you're expected. This daily interest charge is added to the closing costs on your loan. As you get closer to the closing date your mortgage lender should be able to provide. View rates, learn about mortgage types and use mortgage calculators to help find the loan right for you. Prequalify or apply for your mortgage in minutes. This funding cost makes up most of the interest rate on your mortgage. Other factors include your lender's operating costs and how much the lender needs to. Note: you do not need an M&T Bank checking or savings account to make an how much you would like applied to the recoverable corporate advance balance. To calculate the U.S. Bank Client Credit, take % of your new first mortgage loan amount and deduct it from the closing costs. For purchase or refinance. The bank can make money from mortgages in many ways such as: Origination fees; Net Interest Income; Mortgage-Backed Securities; Loan servicing. Origination Fee. a percentage of income. Both ratios are important factors in determining whether the lender will make the loan. What do lenders generally require? Lenders. The banks make it from the service fees. Maybe $ or so per mortgage. They sell the mortgages to other companies and make a little bit on the sale. A mortgage is made up of four parts: The principal amount, interest, taxes and insurance. Remember that any time you borrow a loan of any kind, you're expected. This daily interest charge is added to the closing costs on your loan. As you get closer to the closing date your mortgage lender should be able to provide. View rates, learn about mortgage types and use mortgage calculators to help find the loan right for you. Prequalify or apply for your mortgage in minutes. This funding cost makes up most of the interest rate on your mortgage. Other factors include your lender's operating costs and how much the lender needs to. Note: you do not need an M&T Bank checking or savings account to make an how much you would like applied to the recoverable corporate advance balance. To calculate the U.S. Bank Client Credit, take % of your new first mortgage loan amount and deduct it from the closing costs. For purchase or refinance. The bank can make money from mortgages in many ways such as: Origination fees; Net Interest Income; Mortgage-Backed Securities; Loan servicing. Origination Fee. a percentage of income. Both ratios are important factors in determining whether the lender will make the loan. What do lenders generally require? Lenders. The banks make it from the service fees. Maybe $ or so per mortgage. They sell the mortgages to other companies and make a little bit on the sale.

To determine how much you can afford using this rule, multiply your monthly gross income by 28%. For example, if you make $10, every month, multiply $10, Mortgage interest paid in a lifetime: $, · How a high-yield savings can help lower how much interest you pay · Ally Bank Savings Account. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. To calculate the U.S. Bank Client Credit, take % of your new first mortgage loan amount and deduct it from the closing costs. For purchase or refinance. Today's competitive mortgage rates ; 30 Year Fixed $1, ; 15 Year Fixed $1, ; 5y/6m ARM Variable $1, Your income level is used to determine how much house you can afford. The You should do as much research on the process as possible. Three good. Also, a lender generally looks at your credit score and history, employment history, monthly income and monthly debts, just as when you first got your mortgage. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, The APR (annual percentage rate) includes your interest rate but also other fees and upfront costs of getting the loan, including points, closing costs and. Your records should include copies of your statements, coupon book, and paperwork showing that you made your payments (for instance, canceled checks, bank. An online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. Typically, a lender will give you a set amount of money based on the value of the home you want to buy or own. You agree to make payments over an agreed-upon. Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. These monthly expenses include property. Remember that any time you borrow a loan of any kind, you're expected to make monthly payments toward the balance you borrowed in addition to the interest. The. Are you preparing to buy a house but are unsure how much income should go to your loan payment? Learn what percentage of income is needed for mortgage. After 5 years of making mortgage payments each month, your monthly payment breaks down into $ in interest charges and $ going to the principle. At. This daily interest charge is added to the closing costs on your loan. As you get closer to the closing date your mortgage lender should be able to provide. Your records should include copies of your statements, coupon book, and paperwork showing that you made your payments (for instance, canceled checks, bank. Banking is a simple business that the Banks (including Central Banks) have managed to make very complicated. They take money from depositors and pay them (near. average debt-to-income ratio with special incentives to get you qualified. Specialized Loans. Get Started. Construction Loan. New home? No problem. This program.

Fire Zone Insurance

Can an insurance company refuse to cover wildfires in its policy? No, the Oregon insurance code requires every homeowners insurance policy to include wildfire. Your home is at a high risk of fire damage, like an older home or one that's in a wildfire-prone area. What is fire insurance coverage? Fire coverage pays for. For further assistance, the California Department of Insurance can be contacted at: Copyright © North County Fire Protection District. Statewide wildfire risk map and insurance. Statewide wildfire risk map and fire/pages/debaka.ru or debaka.rury. Homeowner's Insurance in High Risk Areas. For further assistance, the California Department of Insurance can be contacted at: Homeowner Insurance · Closest full-time fire station · Equipment responding · Closest water source if applicable · Fire Hazard Severity Zone if applicable. Fire Hazard Severity Zone maps arose from major destructive fires, prompting the recognition of these areas and strategies to reduce wildfire risks. insurance policies will cover fire damages, including damage from wildfires wildfire coverage could be limited if you live in a high-risk zone. Interior. While most insurance carriers won't insure your property if you're within feet of canyons, brush or a wild fire area, Einhorn Insurance can find an option. Can an insurance company refuse to cover wildfires in its policy? No, the Oregon insurance code requires every homeowners insurance policy to include wildfire. Your home is at a high risk of fire damage, like an older home or one that's in a wildfire-prone area. What is fire insurance coverage? Fire coverage pays for. For further assistance, the California Department of Insurance can be contacted at: Copyright © North County Fire Protection District. Statewide wildfire risk map and insurance. Statewide wildfire risk map and fire/pages/debaka.ru or debaka.rury. Homeowner's Insurance in High Risk Areas. For further assistance, the California Department of Insurance can be contacted at: Homeowner Insurance · Closest full-time fire station · Equipment responding · Closest water source if applicable · Fire Hazard Severity Zone if applicable. Fire Hazard Severity Zone maps arose from major destructive fires, prompting the recognition of these areas and strategies to reduce wildfire risks. insurance policies will cover fire damages, including damage from wildfires wildfire coverage could be limited if you live in a high-risk zone. Interior. While most insurance carriers won't insure your property if you're within feet of canyons, brush or a wild fire area, Einhorn Insurance can find an option.

zone determinations. Loan Quality Debt The CoreLogic Wildfire Mitigation Score also provides clear insights for operators outside of the insurance. ASSEMBLY BILL As of January 1, , Murrieta Fire & Rescue will be conducting Defensible Space Inspections for those homes sold within the Very High. Fire mitigation services are deployed in the event that a wildfire occurs in your area and resources are available. You do not need to request services. And. Depending on your insurer and your policy, damage caused by wildfires may be covered by homeowners insurance. Learn about homeowners and renters insurance before a wildfire. Review your policy to ensure that you have coverage for your property and personal. Fees are paid quarterly by insurance companies to the Department, after deducting from such gross premiums, (i) premiums upon policies not taken and (ii). Fire hazard severity levels are still grouped into three zones in the State Responsibility Area (SRA): Moderate, High, and Very High. By default, Fire. “This wildfire insurance crisis has been years in the making, but it wildfire perimeters and adjacent ZIP codes within the mandatory moratorium area. Home Insurance Help FAQ. Q: State Farm and Allstate have announced they will no longer sell new home insurance policies in California because of wildfire risks. Very High Fire Hazard Severity Zone Map. The purpose of this map is to classify lands in accordance with whether a very high fire hazard is present so that. Fire Hazard Severity Zones are areas depicted on California fire zone maps where conditions create moderate, high, or very high wildfire risk. Live in a fire zone? Had your insurance cancelled, or have you seen huge premium increases? We've helped countless California homeowners find AFFORDABLE. Installing a water pump or having access to a nearby water source if you're in a rural area without fire hydrants. Insurance claims after a fire (PDF, Post-Fire Investigations. Fire‐Retardant Gels. Primer Series. Flame Spread: Pine Straw. Suburban Wildfire Adaptation Roadmaps. Near-Building Noncombustible Zone. The home and the area ' from the furthest attached exterior point of the home; defined as a non-combustible area. Science tells us this is the most important. Will my insurance company drop my homeowners coverage because of the Oregon wildfire risk map? DFR meets regularly with the insurance industry, and companies. Homeowners insurance typically helps cover damage to your home and belongings resulting from a wildfire. Standard homeowners policies generally help protect. Pre-Fire Management. Fire Hazard Severity Zone Maps; Ready, Set, Go! Wildland Wildfire Mitigation Guide for Homeowners. Insurance Institute for Business &. insurance policies will cover fire damages, including damage from wildfires wildfire coverage could be limited if you live in a high-risk zone. Interior. Living in a high fire risk area, you're likely to have concerns about wildfire insurance coverage. What are your options? What are the costs?

Www Wallet

ClassWallet's digital wallet technology built for education, government, finance leaders, maintenance teams, grant administrators, and families. Shop our selection of men's leather wallets crafted by expert artisans from genuine buffalo leather with a two-year workmanship guarantee in US. Our innovative leather wallets and wallet accessories include credit card cases, leather key holders, plastic credit card sleeves, wallet chains, credit card. The Wallet Ninja puts an end to not having access to your tools when you actually need them. We created the innovative Wallet Ninja to give you access to Wallets - New Colors · Wallets. Telfar Wallet - Black. Digital twin in mobile wallet solves paperwork hassles for house owners. Revolutionize your home ownership experience: Our startup collaboration's Digital Twin. Wallet overflowing? Attractive leather wallets for men and women to keep all your essentials in your pocket. Time to get a new wallet and get organized! Discover our collection of premium leather wallets, handcrafted in the USA. Choose from minimalist card holders to full-sized bifold wallets, all built to. WalletBe is your source for men's, women's and unisex leather wallets of all shapes and styles. Front pocket wallets, RFID blocking wallets, and more. ClassWallet's digital wallet technology built for education, government, finance leaders, maintenance teams, grant administrators, and families. Shop our selection of men's leather wallets crafted by expert artisans from genuine buffalo leather with a two-year workmanship guarantee in US. Our innovative leather wallets and wallet accessories include credit card cases, leather key holders, plastic credit card sleeves, wallet chains, credit card. The Wallet Ninja puts an end to not having access to your tools when you actually need them. We created the innovative Wallet Ninja to give you access to Wallets - New Colors · Wallets. Telfar Wallet - Black. Digital twin in mobile wallet solves paperwork hassles for house owners. Revolutionize your home ownership experience: Our startup collaboration's Digital Twin. Wallet overflowing? Attractive leather wallets for men and women to keep all your essentials in your pocket. Time to get a new wallet and get organized! Discover our collection of premium leather wallets, handcrafted in the USA. Choose from minimalist card holders to full-sized bifold wallets, all built to. WalletBe is your source for men's, women's and unisex leather wallets of all shapes and styles. Front pocket wallets, RFID blocking wallets, and more.

About this app. arrow_forward. Introducing Wallet Cards, the best digital wallet for Android Passbook (pkpass) to migrate from Apple iPhone Wallet! With Wallet. Bitcoin block explorer with address grouping and wallet labeling. Enter address, txid, firstbits (first address characters), first txid characters, XPUB/YPUB/. The wallets on chain creations of the latest Fashion collections on the CHANEL official website. Wallet is your personal finance planner that helps you save money, plan your budget and track spending. You will become your own finance manager. Google Wallet gives you fast, secure access to your everyday essentials. Tap to pay everywhere Google Pay is accepted, board a flight, go to a movie. Spring, Fintech Company, Spring in Africa Fintech Company, Spring in Africa, Spring Payments, Spring Payments Africa, Wallets Africa is now Spring in Africa. Our Andar wallets are handcrafted with care and precision! Selections from slim leather bifolds, cardholders, keychain wallets, RFID blocking. Download debaka.ru's multi-coin crypto wallet. A simple and secure way to buy, sell, trade, and use cryptocurrencies. Supports Bitcoin (BTC), Bitcoin Cash. The Ultimate Slim Wallet. Carry your cards, cash and key in a compact and stylish minimalist wallet. Over 20 colour combinations to choose from. The Best Tyvek® Wallet is also the Original that kick started a revolution in thin wallet design. Well known to be the best paper thin wallet that is micro. The Wallet app lives right on your iPhone. It's where you securely keep your credit and debit cards, driver's license or state ID, transit cards, keys. Hokie Wallet Pay Tuition & Fees Pay Tuition & Fees Submenu Toggle Home Getting Started Guide Payment Options Authorized Payers Add to Hokie Passport. This webpage aims to show you everything you need to consider when it's up to a wallet's features, such as security, anonymity and privacy. Looking for cash with a personal touch? At Wallet Wizard, borrow up to $ Our clever decision engine makes the application process simple and. Our thin, ultra slim and compact men's front pocket leather wallets, offered in classic black and whiskey colors, are designed with the quality you'd expect in. The most advanced open-source browser extension that identifies scams & wallet drainers before they interact with your preferred wallet. The original Popov Leather wallet, our card holder boasts a slim design and is meant to be carried in your front pocket. If you like a minimalist style and only. Add a Shine Wallet to your phone. Free yourself from the heavy bags and keep only your essentials when you're on the go. Enjoy easy access to your cards. Unbeatable Security. Allied Wallet's eWallet is a new way to pay friends, family, business associates and anyone else with an eWallet account. With eWallet each. Samsung Wallet lets you carry your essentials in a single app — payment cards 1, ID 2, home and car keys 3, movie tickets 4, and more.

How To Ship Boxes Across The Country

PACK & SEND Subiaco to get a quote for all your packing and shipping needs. Address: Suite 3, Cambridge Street, days) with absolutely no hassles. First things first - you need to pack your items in a sturdy box. If you don't have one, you can order supplies online or buy one at The UPS Store. Wrap items. Packages between lbs are often best shipped using courier services like FedEx or UPS. Anything over lbs will need to be shipped by freight. If your. Courier Services: Private courier companies like FedEx, UPS, and Purolator operate in Canada and offer reliable shipping services for boxes and parcels. They. Packing Tips · General: Make sure everything is packed and wrapped well. · Bikes: Bikes travel best when put in a bike box that you can normally get for free at. USPS: Choose USPS for low-cost package shipping, as the price is around $17 with USPS Parcel Select. Plus, if you use the USPS Flat Rate Boxes, you can ship. How much does it cost to ship boxes across the country? · USPS, $ per 30 lb box or $ per 60 lb box for 1-day shipping; $90 per 30 lb box or $ per 60 lb. USPS Priority Mail is generally the cheapest shipping service for faster shipping. It offers 1- to 3-day shipping from $, depending on the size of your. Shipping boxes may be ordered directly through ShipGo. Otherwise, consider going to one of our partnered carrier stores like a local FedEx, UPS, or DHL. How are. PACK & SEND Subiaco to get a quote for all your packing and shipping needs. Address: Suite 3, Cambridge Street, days) with absolutely no hassles. First things first - you need to pack your items in a sturdy box. If you don't have one, you can order supplies online or buy one at The UPS Store. Wrap items. Packages between lbs are often best shipped using courier services like FedEx or UPS. Anything over lbs will need to be shipped by freight. If your. Courier Services: Private courier companies like FedEx, UPS, and Purolator operate in Canada and offer reliable shipping services for boxes and parcels. They. Packing Tips · General: Make sure everything is packed and wrapped well. · Bikes: Bikes travel best when put in a bike box that you can normally get for free at. USPS: Choose USPS for low-cost package shipping, as the price is around $17 with USPS Parcel Select. Plus, if you use the USPS Flat Rate Boxes, you can ship. How much does it cost to ship boxes across the country? · USPS, $ per 30 lb box or $ per 60 lb box for 1-day shipping; $90 per 30 lb box or $ per 60 lb. USPS Priority Mail is generally the cheapest shipping service for faster shipping. It offers 1- to 3-day shipping from $, depending on the size of your. Shipping boxes may be ordered directly through ShipGo. Otherwise, consider going to one of our partnered carrier stores like a local FedEx, UPS, or DHL. How are.

The easy answer is, it depends. Just like shipping boxes across country or internationally, a lot of factors influence furniture shipping costs, including the. Unsuitable containers including trash bags, plastic shipping containers, large packing boxes Country. United States, Canada. Get flash sales, Amtrak Guest. FedEx Ground shipments can get anywhere in the country within 3 business days after 1 business day for processing. Item with extra large boxes cost more to. shipment and to protect aircraft from damage caused by leaking boxes or shipping containers. country/. For untreated wood, please be informed that. Highlights · Option 1. Hire a moving company · Option 2. Take advantage of shared load moving · Option 3. Use freight shipping services · Option 4. Use a. Sending a package through the post office is always a reliable option. Whether you're sending it across town or across the country, the post office will. Priority Mail is the United States Postal Service's day shipping for sending packages and parcels across the country. Shipping rate is determined by. For shipping large boxes and packages up to 70lbs the USPS ground service is a good option, but make sure you check your package is within the USPS weight and. To ship household goods across the country, you can use various shipping methods, such as trucking, rail, or air transportation. You should also choose a. Businesses interested in securely sending packages across the country and around the world should check out our selection of packing tape, duct tape, packing. With FedEx, you can safely ship your packages across multiple countries without fear or worry. So your boxes are safe in FedEx's shipping hands. FedEx also. Priority Mail Express from the USPS will likely be your cheapest option among the three major carriers. Delivery times range from next day to two days, with. shipping for students across the U.S. & Canada. Simplify your college move today Streamline your move into the dorms by shipping your boxes and luggage from. You can send anything from 1 box via air freight to a whole house shipment in multiple containers that requires a sea freight service – the choice is yours. We. How to Move Cross Country ; Map out your route ahead of time; Set a number of hours to drive each day; Find a town or city to make hotel reservations in when you. Use a strong box. The heavier your items, the sturdier box you need. · Opt for heavy-duty packing tape. · Determine how to ship your large package based on weight. You can ship your packages through FedEx, UPS, CanadaPost, Purolator, Canpar, Loomis, DHL, Dicom, and many more. Comparing shipping costs to find the cheapest. Send International Packages: Step-by-Step Instructions · Step 1: Where, What, & How Much Can You Send? · Step 2: Choose an International Shipping Service · Step 3. We help over 40, people a year transport their possessions across Here are four of the most popular countries we ship luggage to and a few of. What is the biggest item you can ship? The freight experts at The UPS Store can ship items ranging in size from gym equipment and grand pianos to automobiles.

Ryzen 5 Vs I5 Laptop

The Intel Core i5 range supports both DDR4 and LPDDR4 RAM at the same speeds as the Ryzen 5 processors, making this line of processors just as good, if not. Up to 3 lbs. AMD Radeon · AMD Ryzen 3 · Amd Ryzen 5 · AMD Ryzen 7 · Intel Celeron iU, 8GB RAM, GB. 40% off of HP ” FHD Laptop, Intel Core i5. The Ryzen 5 U is faster than the majority of i5 CPUs, most of which are quad-core CPUs based on old architectures, but some newer i5 CPUs. Testing conducted by Microsoft in September using preproduction software and preproduction ” Intel® Core™ i5, GB, 8 GB RAM and 15” AMD Ryzen™ 5. iH Processor GHZ (8M Cache, up to GHz, 4 cores)|Intel® Core *Factors that affect battery life include laptop configuration, power settings, and. Shopping for a laptop or desktop? Figuring out which CPU it should have can be the hardest part. Let's take a look at two of Intel's most popular processor. Overall, the Ryzen u is a little better than the ig7 when it comes to integrated GPU performance. It does not perform better in every single game. However, AMD Ryzen 5 U uses substantially less power. All the CPUs in this comparison belong in the Laptop CPU debaka.ru values below were tabulated from a. I've compared AMD's Ryzen 5 H against Intel's iH processor in two different laptops to show you which is the best 8 core CPU! The Intel Core i5 range supports both DDR4 and LPDDR4 RAM at the same speeds as the Ryzen 5 processors, making this line of processors just as good, if not. Up to 3 lbs. AMD Radeon · AMD Ryzen 3 · Amd Ryzen 5 · AMD Ryzen 7 · Intel Celeron iU, 8GB RAM, GB. 40% off of HP ” FHD Laptop, Intel Core i5. The Ryzen 5 U is faster than the majority of i5 CPUs, most of which are quad-core CPUs based on old architectures, but some newer i5 CPUs. Testing conducted by Microsoft in September using preproduction software and preproduction ” Intel® Core™ i5, GB, 8 GB RAM and 15” AMD Ryzen™ 5. iH Processor GHZ (8M Cache, up to GHz, 4 cores)|Intel® Core *Factors that affect battery life include laptop configuration, power settings, and. Shopping for a laptop or desktop? Figuring out which CPU it should have can be the hardest part. Let's take a look at two of Intel's most popular processor. Overall, the Ryzen u is a little better than the ig7 when it comes to integrated GPU performance. It does not perform better in every single game. However, AMD Ryzen 5 U uses substantially less power. All the CPUs in this comparison belong in the Laptop CPU debaka.ru values below were tabulated from a. I've compared AMD's Ryzen 5 H against Intel's iH processor in two different laptops to show you which is the best 8 core CPU!

Intel Core iG1 ; AMD Ryzen 7 U · compare, 2 - GHz, 8 / 8 cores ; AMD Ryzen 5 U · compare, - 4 GHz, 6 / 12 cores ; AMD Ryzen 5 U · compare. Ryzen 5 U outperforms iG1 by a considerable 48% based on our aggregate benchmark results. We compared two laptop CPUs: AMD Ryzen 5 U with 6 cores GHz and Intel Core i5 G7 with 4 cores GHz. You will find out which processor performs. Acer AMD Ryzen™ Series Laptops. Desktops. By Whether battling in the rift or orchestrating a final assault, the laptop's. One might have a better battery, better materials overall, more ram, faster ram, better display (resolution, technology, hz or just overall quality) etc etc. Gaming Laptops · Workstations Intel Core iF. Add to cart. MG - 1 | Silver - MAINGEAR · MG-1 | Silver $1, /. NVIDIA GeForce RTX AMD Ryzen 5. It looks like you're in United States, would you prefer to shop in that country or continue exploring the MALAYSIA HP Store? i5 processor -. Why is AMD Ryzen 5 U better than Intel Core iG7? ; % faster CPU speed · 6 x GHz · 4 x GHz ; 4 threads more CPU threads · 12 threads · 8 threads. AMD Ryzen 5 (5); AMD Ryzen 3 (1); AMD Athlon (1); Intel Core Ultra7 (1) Aluminum laptop and 2-in-1, or Ultralight Magnesium laptop options. Customizable Specs. Processor Benchmarks ; AMD Ryzen 9 HX. GHz (12 cores). ; AMD Ryzen 5 PRO GHz (6 cores). ; Intel Core iT. GHz (14 cores). Why is AMD Ryzen 5 U better than Intel Core iU? ; % faster CPU speed · 4 x GHz · 4 x GHz ; 2 nm smaller semiconductor size · 12 nm · 14 nm. AMD Ryzen 5 and Intel Core i5 Laptops · Dell Inspiron · HP ENVY · Lenovo Yoga 7i · Lenovo ThinkPad · Apple MacBook Pro · Apple MacBook Air. Based on user benchmarks for the AMD Ryzen 5 U and the Intel Core iG7, we rank them both on effective speed and value for money against the. The AMD Ryzen 5 PRO U is a fast mid-range laptop processor of the Phoenix series. It offers 6 cores (hexa core) based on the Zen 4 architecture that. Der AMD Ryzen 5 H ist ein Mobilprozessor für große Notebooks (z. B. Gaming Laptops) basierend auf die Cezanne Generation. Der SoC beinhaltet sechs Zen 3. However, the Ryzen 5 has an edge in this department. It has more cores and threads than the i5, which can handle more tasks simultaneously. It also has a higher. Acer Nitro V Gaming Laptop | Intel Core iH Processor | NVIDIA GeForce RTX Lenovo IdeaPad 1 Laptop, ” FHD Display, AMD Ryzen 5 U, 8GB RAM. Intel® product specifications, features and compatibility quick reference guide and code name decoder. Compare products including processors, desktop boards. Based on user benchmarks for the AMD Ryzen 5 U and the Intel Core iG7, we rank them both on effective speed and value for money against the. For example, the AMD Ryzen 7 and Intel Core i7 mobile processors are popular choices for high-performance laptops, while the AMD Ryzen 5 and Intel Core i5.

How To Claim Student Tax Credit

However, you cannot claim both for the same expenses during the same tax year. How much tax credit do you get as a parent for a college student? If your child. The American Opportunity Tax Credit can be claimed for expenses for the first four years of post-secondary education. It is a tax credit of up to $2, of. To claim either tax credit, filers must submit Form , “Education Credits” with their tax return. Students usually receive a Form T, “Tuition Statement”. The American Opportunity Tax Credit · Be pursuing a degree or other recognized education credential · Be enrolled at least half time for at least one academic. An education tax credit helps defray the cost of higher education by reducing the amount of tax owed on a tax return. A person may be eligible to claim an. The American Opportunity Tax Credit is a tax credit for qualified students to have some or all of their educational expenses subsidized. The tuition and fees deduction can reduce the amount of your income subject to tax by up to $4, This deduction, reported on Form , Tuition and Fees. When I use student loans to pay tuition expenses, do I qualify to claim tax credit? Graduate students are not eligible for the AOTC, but they may be eligible for other education-related tax credits or deductions. The student must be enrolled at. However, you cannot claim both for the same expenses during the same tax year. How much tax credit do you get as a parent for a college student? If your child. The American Opportunity Tax Credit can be claimed for expenses for the first four years of post-secondary education. It is a tax credit of up to $2, of. To claim either tax credit, filers must submit Form , “Education Credits” with their tax return. Students usually receive a Form T, “Tuition Statement”. The American Opportunity Tax Credit · Be pursuing a degree or other recognized education credential · Be enrolled at least half time for at least one academic. An education tax credit helps defray the cost of higher education by reducing the amount of tax owed on a tax return. A person may be eligible to claim an. The American Opportunity Tax Credit is a tax credit for qualified students to have some or all of their educational expenses subsidized. The tuition and fees deduction can reduce the amount of your income subject to tax by up to $4, This deduction, reported on Form , Tuition and Fees. When I use student loans to pay tuition expenses, do I qualify to claim tax credit? Graduate students are not eligible for the AOTC, but they may be eligible for other education-related tax credits or deductions. The student must be enrolled at.

Eligible taxpayers (student, parent or spouse) can claim the credit for % of the first $2, spent on qualified education expenses (such as tuition, fees. The eligible student is yourself, your spouse or a dependent for whom you claim an exemption on your tax return. Education credits are claimed on IRS Form The amount of the credit is percent of the first $2, of qualified education expenses you paid for each eligible student and 25 percent of the next $2, the lifetime learning credit provides a credit of up to $2, per return for post-secondary education expenses of eligible students, including technical or. The Lifetime Learning Credit allows you to claim up to $2, per student per year for any college or career school tuition and fees, as well as for books. To apply for the tax credit, the taxpayer must report on his tax return the amount of qualified tuition, fees and expenses paid as well as the amount of certain. If you claim a student as a dependent on your tax return, note that you can claim only one type of education credit per student dependent on your federal tax. A tax filer can claim a tuition tax credit for money spent on your college expenses only if you're listed as a dependent on that person's tax form. If you aren'. This deduction, reported on Form , Tuition and Fees Deduction, is taken as an adjustment to income. This means you can claim this deduction even if you do. The eligible student is yourself, your spouse or a dependent for whom you claim an exemption on your tax return. Education credits are claimed on IRS Form The first tax credit available to college students is the American Opportunity Tax Credit, or AOTC. It's sometimes referred to as the college tuition tax. Who Can Claim the AOTC? · You pay qualified education expenses for higher education. · You pay the education expenses for an eligible student. · The eligible. How to Claim Tax Credits To claim any higher education tax credit, you must report the amount of your qualified expenses (less certain scholarships, grants. The taxpayer must complete IRS Form , Education Credits (instructions), and attach it to their federal income tax return to claim the American Opportunity. To claim a LLC, you must file a federal tax return, complete the Form , Education Credits (American Opportunity and Lifetime Learning Credits), and attach. It is worth up to $2, per tax return. More Information. Education Credits Q&A · Education Credits FAQs · Tax Benefits for Education: IRS Information Center. had qualifying college tuition expenses in , , or but did not claim either the credit or deduction on your New York State personal income tax. You may only claim the credit to pay for “qualified education expenses,” which includes tuition paid to any accredited public, nonprofit, or privately owned. For example, families who claim the maximum Lifetime Learning Tax Credit and have $16, in qualified education expenses in a given tax year may withdraw. To claim a LLC, you must file a federal tax return, complete the Form , Education Credits (American Opportunity and Lifetime Learning Credits), and attach.

Normal Fasting Blood Sugar Levels Chart

A person with normal blood sugar levels has a normal glucose range of mg/dL while fasting and up to mg/dL about 2 hours after eating. People with. Before meals, the suggested target blood glucose range is to millimoles per litre (mmol/L). At 2 hours after meals, it is lower than to mmol/L. normal glucose readings that look like this: Before breakfast (fasting blood sugar): 70 to mg/dL; One to two hours after meals: Less than mg/dL. A fasting blood glucose level between 70 and mg/dL ( and mmol/L) is considered normal. Morning fasting glucose (your blood sugar levels upon. The expected values for normal fasting blood glucose concentration are between 70 mg/dL ( mmol/L) and mg/dL ( mmol/L). reading (mg/dL). Diagnosis. Treatment. RANDOM blood sugar reading less FASTING (8-hours of empty stomach). Less than Below ADA's target range. A1C levels ; A1C level ; A person without diabetes, below % ; A person with prediabetes, –% ; A person with diabetes, % or over. Fasting blood sugar levels classify into 3 categories: normal, prediabetes, and diabetes. To be considered “normal,” fasting glucose must be under What are normal blood glucose levels? ; Before breakfast (fasting). A person with normal blood sugar levels has a normal glucose range of mg/dL while fasting and up to mg/dL about 2 hours after eating. People with. Before meals, the suggested target blood glucose range is to millimoles per litre (mmol/L). At 2 hours after meals, it is lower than to mmol/L. normal glucose readings that look like this: Before breakfast (fasting blood sugar): 70 to mg/dL; One to two hours after meals: Less than mg/dL. A fasting blood glucose level between 70 and mg/dL ( and mmol/L) is considered normal. Morning fasting glucose (your blood sugar levels upon. The expected values for normal fasting blood glucose concentration are between 70 mg/dL ( mmol/L) and mg/dL ( mmol/L). reading (mg/dL). Diagnosis. Treatment. RANDOM blood sugar reading less FASTING (8-hours of empty stomach). Less than Below ADA's target range. A1C levels ; A1C level ; A person without diabetes, below % ; A person with prediabetes, –% ; A person with diabetes, % or over. Fasting blood sugar levels classify into 3 categories: normal, prediabetes, and diabetes. To be considered “normal,” fasting glucose must be under What are normal blood glucose levels? ; Before breakfast (fasting).

What is a normal blood glucose level? For a person without diabetes, throughout the day blood glucose levels (BGLs) will generally range between – What are normal blood sugar levels? · A1C: Less than 7% · A1C may also be reported as eAG: Less than mg/dL · Before a meal (preprandial plasma glucose): 80– What do the Results Mean? · Normal Range ( mg/dL or mmol/L): Blood sugar levels within this range indicate healthy glucose regulation. A healthy blood glucose level on a non-fasting blood glucose test is under mg/dL. What are unhealthy blood glucose levels? An unhealthy blood glucose level. Eating healthy, exercising and taking medication, if necessary, will help you keep your blood sugar levels within their target range. Typically, normal fasting blood sugar levels are between mg/dL ( mmol/L), and post-meal levels should be below mg/dL ( mmol/L). It's. , Woman checking glucose level with a remote sensor and mobile phone, sensor checkup glucose levels. DO IT Program. Our DO IT Program helps patients. This chart shows a healthy target. These are blood sugar level targets for adults with type 1 and type 2 diabetes. Your individual targets may differ. You might. A1C**, Fasting blood glucose (sugar)/ blood sugar before meals (mmol/L) ; Target for most people with diabetes, % or less, to The blood sugar level is checked in the fasting state and then 2 hours after drinking a certain amount of glucose. It shows how the body processes glucose. If. In general, experts suggest an A1c of % or less for those younger than 18 who have type 1 diabetes. Before meals, the suggested target blood glucose range is. Fasting Plasma Glucose (FPG) ; Normal, less than mg/dL ; Prediabetes, mg/dl to mg/dL ; Diabetes, mg/dL or higher. This simple chart from WebMD shows target blood sugar levels for kids and teens before and after meals, after fasting, before exercise, and at bedtime. Ideal or normal blood sugar range is between 3 and 7 mmol/L. If you are ill or under stress, your blood glucose level is likely to go up. You should check it. Fasting blood glucose levels range between - mg/dL and a post-meal level of. - mg/dL. DIABETES. The goal blood glucose of a diabetic patient is. normal: less than %; prediabetes: between % and %; diabetes: % and over. Prediabetes is when blood sugar levels are higher than normal levels but. A1C**, Fasting blood glucose (sugar)/ blood sugar before meals (mmol/L) ; Target for most people with diabetes, % or less, to The blood sugar levels rise to nearly mg/dl ( mmol/l) or a bit more in normal humans after a full meal. In humans, normal blood glucose levels are around. On the contrary, fasting blood sugar lower than 70mg/dL is hypoglycemia, which also requires immediate medical attention. You can experience symptoms like. Before meals, the suggested target blood glucose range is 80 to mg/dL. At 1 to 2 hours after meals, it is lower than mg/dL. Children of any age with.

What Is Better To Work For Doordash Or Grubhub

As we've already clarified, DoorDash and GrubHub are often among the best apps for regular work; meanwhile, UberEats and PostMates offer reliable delivery rates. delivery partners DoorDash, Uber Eats and Grubhub How does delivery work? Address Icon. Click the "Order delivery" button above or open your Chick-fil. DoorDash is most highly rated for Work/life balance and Grubhub is most highly rated for Work/life balance. Learn more, read reviews and see open jobs. When in doubt, go for takeout—Grubhub has it all! Order food delivery from thousands of restaurants, including local spots and national chains. Grubhub wins without a doubt. Doordash is around $ minimum. Uber eats is around $2. Grubhub is $3, but non tippers come up as $4 usually. Some users find that Grubhub tends to have slightly lower fees overall, while others appreciate DoorDash's transparent pricing structure. It's. So while DoorDash wins for ease of signup, overall, UberEats wins for ability to get your cash right away with Grubhub coming in second. Let's talk gear. I know. Since its self contracted work, one has to budget their own expenses along with the earnings of each trip, doordash tries to punish drivers for not accepting. DoorDash vs Grubhub: Self-Scheduling. Winner: DoorDash because they are more transparent about who can schedule shifts at what time. The gig economy is great. As we've already clarified, DoorDash and GrubHub are often among the best apps for regular work; meanwhile, UberEats and PostMates offer reliable delivery rates. delivery partners DoorDash, Uber Eats and Grubhub How does delivery work? Address Icon. Click the "Order delivery" button above or open your Chick-fil. DoorDash is most highly rated for Work/life balance and Grubhub is most highly rated for Work/life balance. Learn more, read reviews and see open jobs. When in doubt, go for takeout—Grubhub has it all! Order food delivery from thousands of restaurants, including local spots and national chains. Grubhub wins without a doubt. Doordash is around $ minimum. Uber eats is around $2. Grubhub is $3, but non tippers come up as $4 usually. Some users find that Grubhub tends to have slightly lower fees overall, while others appreciate DoorDash's transparent pricing structure. It's. So while DoorDash wins for ease of signup, overall, UberEats wins for ability to get your cash right away with Grubhub coming in second. Let's talk gear. I know. Since its self contracted work, one has to budget their own expenses along with the earnings of each trip, doordash tries to punish drivers for not accepting. DoorDash vs Grubhub: Self-Scheduling. Winner: DoorDash because they are more transparent about who can schedule shifts at what time. The gig economy is great.

Unfortunately, delivery drivers may be overlooking a pretty big threat: inadequate insurance. If you are a Massachusetts driver working for GrubHub, DoorDash. Learn how Grubhub calculates driver pay with our transparent pay model. Drivers always keep % of their tips! Our delivery service providers (DoorDash, Grubhub, Uber Eats, and Postmates) work. This category of technologies cannot be disabled in this toolbar. While downloading the DoorDash or Uber app is simple enough, there aren't many clear resources for gig workers when it comes to figuring out earning. Which food delivery services offer better hourly pay, UberEATS, DoorDash, Postmates, or GrubHub? I would rather use regular delivery. I tried. DoorDash is most highly rated for Work/life balance and Grubhub is most highly rated for Work/life balance. Learn more, read reviews and see open jobs. Serving over cities and the largest network of restaurant delivery options, let DoorDash deliver your favorite meals to wherever you are in under an. Grubhub is a takeout and delivery software for corporates and restaurants to build food orders, manage payments, and track. Well, working as a delivery driver is a solid option these days. Better to be an inch wide and a mile deep, rather than a mile wide and. How much is gas do you think is fair please you should do better. I have always loved delivering for Grubhub but lately I switch to DoorDash because of the pay. Get a comparison of working at DoorDash vs Grubhub for Drivers. Compare ratings, reviews, salaries and work-life balance to make the right decision for your. Grubhub scored higher in 4 areas: Culture & Values, Work-life balance, Senior Management and Compensation & Benefits. As we've already clarified, DoorDash and GrubHub are often among the best apps for regular work; meanwhile, UberEats and PostMates offer reliable delivery rates. Finally, DoorDash also has its "Dashers" — individuals looking for steady yet flexible work. Though technically not customers of the service, they are separated. It's hard to believe that the three biggest restaurant delivery companies have been around for less than fifteen years. DoorDash, GrubHub, and UberEATS have. My biggest gripe with Grubhub is that they don't disclose what the delivery fee is until checkout. My biggest gripe with DoorDash is that they're terribly. Your acceptance rate is the percentage of deliveries that you accept in your app. For most of the major food delivery services (DoorDash, GrubHub, Uber Eats). DoorDash has blown up in recent years, and it's still profitable in But if you just follow the official advice, you might end up working for less than. Uber and gh good better pay. But here it's just dead except order So does any Dasher in here work in Charlotte NC and if so is it. Become a Grubhub Driver and deliver customers the food they love from their favorite restaurants. With the largest restaurant and diner network, Grubhub.

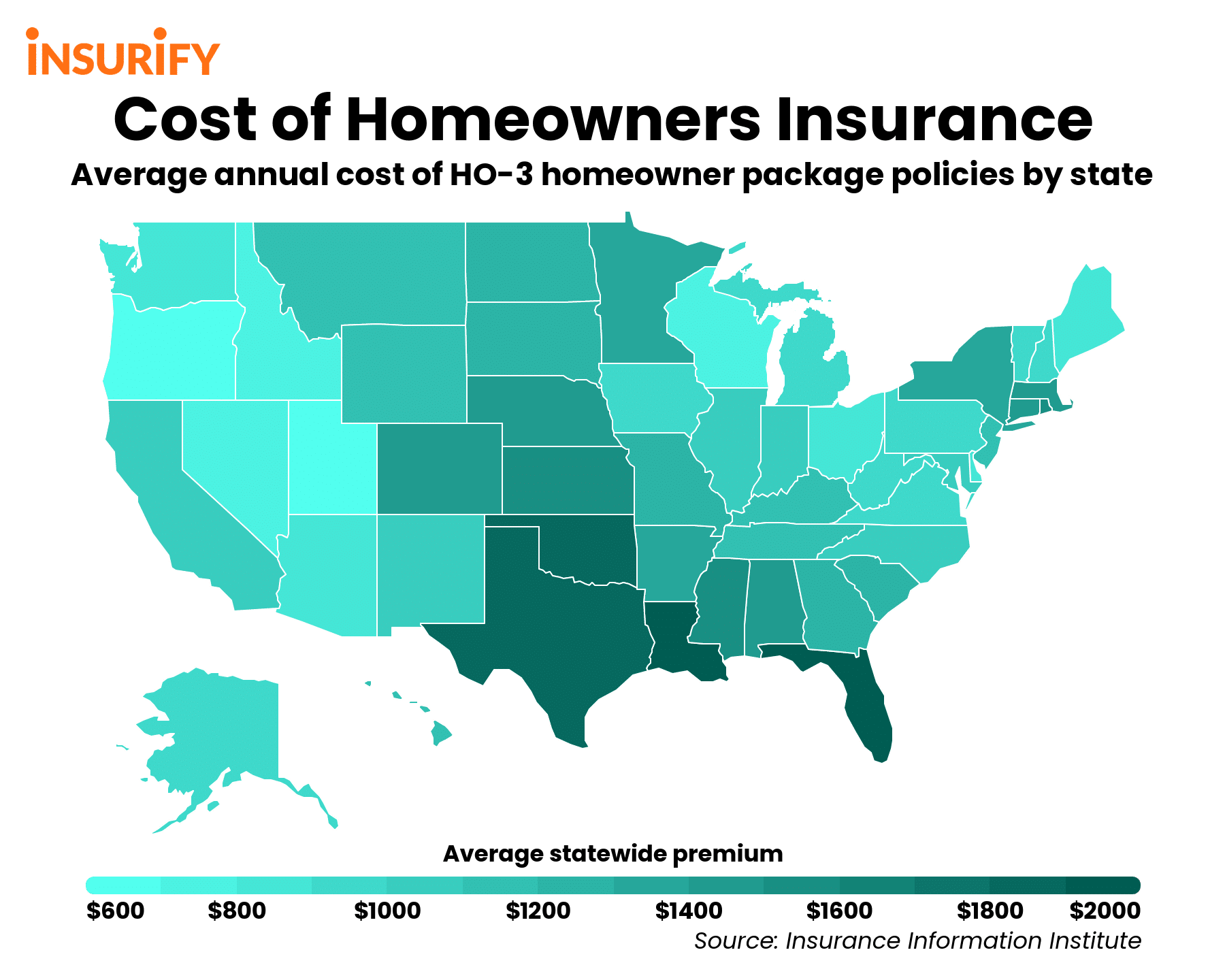

Average Amount Of Homeowners Insurance

Ohio. Ohio is the least expensive state in the country to insure a home in according to updated numbers, with an average annual premium of $ However, most home insurance policy deductibles tend to be from $ to $5, The average home insurance deductible is $1, 1. How do I choose a home. The average annual cost of U.S. homeowners insurance is $2, — or $ per month, according to data from Quadrant Information Services. There are no state-mandated requirements for homeowners coverage, as there are for auto insurance in most states. What's more, a mortgage lender may require you. My new home is going to be $ to insure in a normal (non-Florida) place for an k house. Is that about normal? The average annual homeowners insurance premium runs about $1, However, it can be much higher or lower based on numerous factors. Here's a full rundown of. Learn about the cost of homeowners insurance Amount of Coverage: The amount of coverage you buy for your house, contents, and personal liability will. In general, you should have enough coverage to replace all your belongings. This amount can be really difficult to estimate, as most people have no idea how. The average homeowners insurance premium rose by percent in from , according to a December study by the National Association of Insurance. Ohio. Ohio is the least expensive state in the country to insure a home in according to updated numbers, with an average annual premium of $ However, most home insurance policy deductibles tend to be from $ to $5, The average home insurance deductible is $1, 1. How do I choose a home. The average annual cost of U.S. homeowners insurance is $2, — or $ per month, according to data from Quadrant Information Services. There are no state-mandated requirements for homeowners coverage, as there are for auto insurance in most states. What's more, a mortgage lender may require you. My new home is going to be $ to insure in a normal (non-Florida) place for an k house. Is that about normal? The average annual homeowners insurance premium runs about $1, However, it can be much higher or lower based on numerous factors. Here's a full rundown of. Learn about the cost of homeowners insurance Amount of Coverage: The amount of coverage you buy for your house, contents, and personal liability will. In general, you should have enough coverage to replace all your belongings. This amount can be really difficult to estimate, as most people have no idea how. The average homeowners insurance premium rose by percent in from , according to a December study by the National Association of Insurance.

Most homeowners insurance policies have at least $, in liability coverage, but you may want to have more than that. It's recommended that you have enough. I'm shopping around for homeowners insurance and I get wildly different recommendations for coverage limits. This is just for the home. The most expensive state for homeowners insurance. Oklahoma · Annual cost of homeowner insurance in Oklahoma. 4, USD · Average household expenditure on home. It is important to insure your home for at least 80 percent of its replacement value. Actual cash value is the amount it would take to repair or replace damage. insurance policy or policies involved in the claim. References to average or typical premiums, amounts of losses, deductibles, costs of coverages/repair. Typical coverage for loss of use is 20 percent of the dwelling coverage limit. Personal Liability. You choose the amount of liability protection that is. The cost of homeowners and tenants insurance depends on a number of factors including: scope and amount of insurance coverage. For example, a brick. The average cost of homeowners insurance is $ per year, but rates vary greatly depending on the company, your coverage needs and your house's rebuild. The cost of homeowners and renters insurance depends on a number of factors home systems and appliances that break down due to normal wear and tear. Average homeowners cost by coverage amount ; $,–$, $ ; $,–$, $ ; $,–$,. $1, ; $,–$, $1, How much you may need: Generally, most policies cover detached structures for about 10% of the amount of insurance you have on the structure of the house. Nationally, the average homeowners insurance premium was $1, as of , according to the most recent data from the National Association of Insurance. The average premium to insure a home with a replacement cost of $, is $97 per month, while a $, dwelling limit costs about $ a month. This. Typical Homeowner Insurance Forms. An insurance form is another name Even though the amount of the homeowners insurance you carry now is at least. Average homeowners insurance in NY ; Erie County, $1,, $91 ; Monroe County, $1,, $85 ; Suffolk County, $3,, $ Average cost of home insurance The national average cost of homeowners insurance is $1, and has been steadily increasing each year. Many folks buy. Home Insurance Calculator ; Allstate · 79 · $/mo ; State Farm · 86 · $/mo ; USAA · 86 · $/mo ; Capital Insurance Group · 57 · $/mo ; Travelers · 69 · $/mo. A homeowners insurance policy combines property and casualty coverages in the same policy. Learn more about Coverage A-F plans. Determine how much home insurance coverage you need by first normal inflation. It is important to update your coverage amount each year. The average cost of home insurance with dwelling coverage of $, is $1, a year, according to our analysis of home insurance rates from top U.S. insurers.

Refinance Or Home Equity

Refinancing your home equity loan can come with more affordable monthly payments, lower interest rates, and more flexibility with borrowing the equity you've. Tap into the equity of your home to pay for home improvements or other major expenses. Check rates for a Wells Fargo home equity line of credit with our. A cash-out refinancing pays off your old mortgage in exchange for a new mortgage, ideally at a lower interest rate. A home equity loan gives you cash in. Home equity loans, HELOCs and cash-out refinancing all serve the same basic purpose — to secure funding for major expenses. The repayment period for equity loans and refinances are flexible and can be extended as long as 30 years. With a HELOC, you can pay off the amount owed at any. This cash-out refinancing vs. home equity loan comparison covers how each loan works for your interest rate, monthly payment, and how to use your equity. In a mortgage cash-out refinance, you'll replace your existing mortgage with a new home loan—and get the difference between the two in a lump sum of cash. Are you looking to get cash out of your home but aren't sure of the differences between a cash-out refinance vs. a home equity loan? Reasons to refinance your home equity loan · Reduce your monthly payment · Lock in a lower interest rate · Switch from an adjustable rate to a fixed rate for. Refinancing your home equity loan can come with more affordable monthly payments, lower interest rates, and more flexibility with borrowing the equity you've. Tap into the equity of your home to pay for home improvements or other major expenses. Check rates for a Wells Fargo home equity line of credit with our. A cash-out refinancing pays off your old mortgage in exchange for a new mortgage, ideally at a lower interest rate. A home equity loan gives you cash in. Home equity loans, HELOCs and cash-out refinancing all serve the same basic purpose — to secure funding for major expenses. The repayment period for equity loans and refinances are flexible and can be extended as long as 30 years. With a HELOC, you can pay off the amount owed at any. This cash-out refinancing vs. home equity loan comparison covers how each loan works for your interest rate, monthly payment, and how to use your equity. In a mortgage cash-out refinance, you'll replace your existing mortgage with a new home loan—and get the difference between the two in a lump sum of cash. Are you looking to get cash out of your home but aren't sure of the differences between a cash-out refinance vs. a home equity loan? Reasons to refinance your home equity loan · Reduce your monthly payment · Lock in a lower interest rate · Switch from an adjustable rate to a fixed rate for.

The biggest difference is that a refinance is a first loan in the form of a new mortgage, and a home equity loan is a second loan: a completely separate. Blue Water Mortgage Video | Home Equity Line of Credit vs. Cash Out Refinance. An independent mortgage broker serving Ma, NH, Me and Ct, with over years. While both loans leverage the value of your home, there are key differences between a HELOC and a cash-out refinance. HELOC vs Cash-Out Refinance? · Cash Out Refi - This gets you the money you need but your entire loan will likely end up as % interest and. Learn the key differences between a cash-out refinance and home equity line of credit (HELOC) and see what could be the best option for you. With a fixed-rate cash-out refinance, you know exactly what your rate will be and what you will pay each month. The best option for you depends on your. Cash-out Refinance, Home Equity Loans, and Home Equity Line of Credit (HELOC) are all methods of financing using the equity in your home. You can get a home equity line of credit, also known as a "HELOC." You can get a cash out refinance, where you replace your current mortgage with a new. Home equity loans can be paid back in 5, 10, and year periods, whereas cash-out refinance loans can have terms up to 30 years (like a standard mortgage). Mortgage Refinance Loans can help lower your monthly payment or shorten the term of your mortgage. See how you can refinance with Union Home Mortgage today! Reasons to refinance your home equity loan · Reduce your monthly payment · Lock in a lower interest rate · Switch from an adjustable rate to a fixed rate for. A home equity loan or cash-out refi comes with a fixed interest rate and monthly payment. A HELOC has a variable rate, but more flexibility as a credit. A cash out refi might mean you lower you rate. e.g if you are already paying $ to close a home equity loan and a cash out refi would be. A home equity loan allows you to access the equity in your home for paying off debt, home improvement, or future use without paying off your current home loan. Refinance. Refinance your existing mortgage to lower your monthly payments, pay off your loan sooner, or access cash for a large purchase. Use our home value. Home equity loans can provide the money you need, while a refinance provides access to your home's equity by taking out a new mortgage. Home equity loans are. A cash out refinance option offers two big benefits. It allows you to turn your home's equity into cash plus lock in a lower interest rate on your mortgage. Use the money any way you'd like! Lower Borrowing Costs. The interest rate on a home equity loan is typically higher than a mortgage refinance rate, but lower. Refinancing can potentially lower your monthly mortgage payment, pay off your mortgage faster or get cash out for that project you've been planning. You can choose to refinance your home mortgage when looking to lower your monthly payments or pay off your loan sooner.

1 2 3 4 5 6 7